Points to Note Regarding Electronic Invoices Based on Government Decree 70/2025/ND-CP

2025/07/25

- Khuu Buu Thinh

Introduction

In Vietnam’s tax administration system, the basic legal framework for the use of electronic invoices and evidence was established by Decree No. 123/2020/ND-CP (dated October 19, 2020).To respond to practical demands and the trend of digital transformation, the government promulgated Decree No. 70/2025/ND-CP (dated March 20, 2025, hereinafter referred to as “Decree 70/2025”), which amends and supplements certain provisions of Decree 123/2020/ND-CP, and it came into effect on June 1, 2025.

This report summarizes the key points regarding electronic invoices that came into effect from June 1, 2025.

1. Timing of Electronic Invoice Issuance

a) Sale of goods (including transfer or sale of public property, and sale of national treasury reserves): The invoice is issued at the time the ownership or usage rights of the goods are transferred to the purchaser, regardless of whether payment has been collected.

b) Export of goods (including export processing): The timing for issuing electronic commerce invoices, electronic VAT invoices, and electronic sales invoices can be decided at the seller’s discretion, but they must be issued by the next business day at the latest following the customs clearance completion date based on the Customs Act.

c) Service provision: It is at the point when the service provision is completed, regardless of whether payment collection has occurred (including services provided to foreign organizations and individuals). If payment is collected before or during the service provision, the time of collection is considered the invoicing time (excluding receipt of deposits or advance payments to ensure the fulfillment of contracts such as accounting, auditing, financial and tax consulting, price evaluation, technical design, supervisory consulting, and construction investment project creation).

d) For large volumes of product sales and service provisions that occur regularly and require significant time for data reconciliation (e.g., television advertising, e-commerce, telecommunications, logistics, information technology, banking, international remittances, securities, electronic lotteries, etc.): an invoice must be issued once the data reconciliation between the parties is completed. Additionally, the date of completion of data reconciliation is required to be within 7 days after the month in which the service was provided or within 7 days after the end of the agreed period.

The agreed period is based on the contract between the seller and the buyer.

e) Financing Activities: For loans based on loan agreements, the timing of issuing the invoice is determined according to the interest collection period specified in the contract.

If interest is collected in advance from the borrower, the collection date is regarded as the invoice issuance date.

f) Taxi Transportation Business (using fare calculation software): At the completion of transportation, an electronic invoice is issued, and the data is transmitted to the tax authorities.

g) Insurance Business: In accordance with the Insurance Business Act, an invoice is issued at the point when sales are recorded.

h) Casino and electronic gaming business: Issue an electronic invoice within one day from the sales confirmation date and transfer the data to the tax authorities.

The data should include the amount collected, minus the amount returned to the players.

Note: When the time of creating the electronic invoice differs from the time of signing, the timing for sending it to the tax authorities for code issuance on the same day as signing (for invoices with a tax authority certification code) or the timing for transferring the electronic invoice data to the tax authorities (for invoices without a tax authority certification code) must be within the next business day after the invoice creation date at the latest. Additionally, the seller shall declare VAT based on the time the invoice is created, and the buyer shall verify that the format and content of the invoice are appropriate and declare VAT based on the time of receipt.

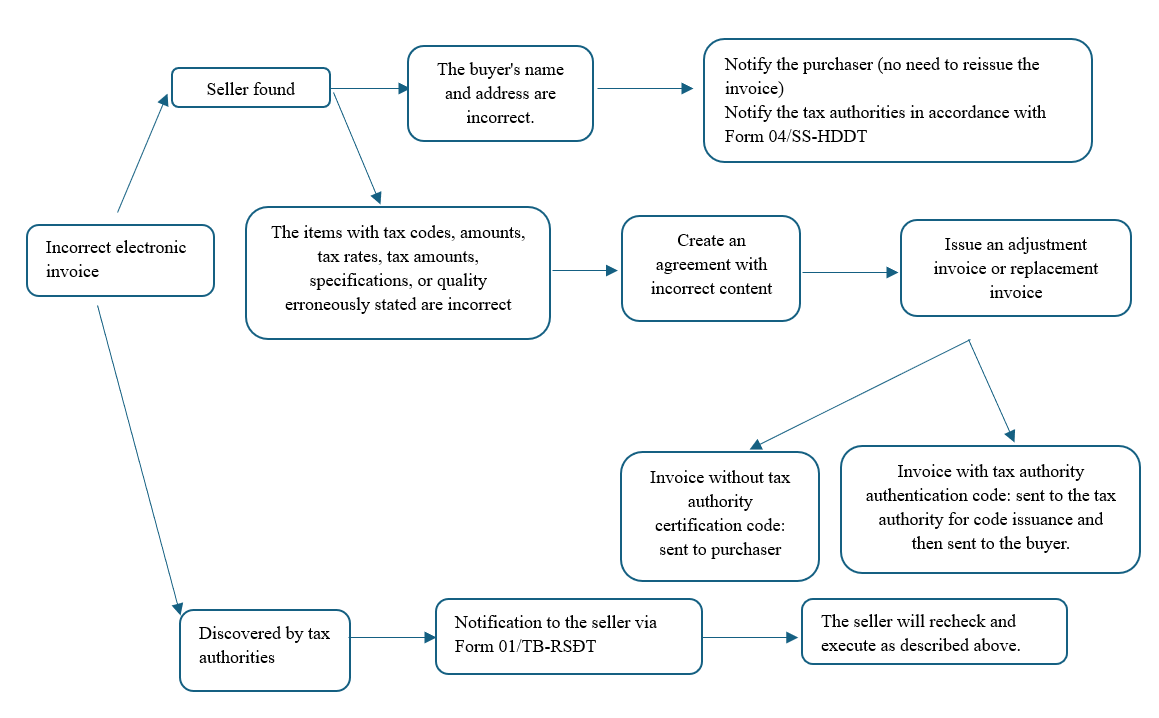

2. Procedure for handling errors in issued electronic invoices

When there is an error in an issued electronic invoice, it must be handled according to the following procedure (Decree 70/2025 Article 1, Paragraph 13).

3. Handling electronic invoices upon return of goods

Until now, the tax authorities had issued numerous official letters guiding the targets for issuing invoices, but there was no unified view regarding returns. This point has been clarified in Government Ordinance 70/2025. Specifically, if the purchaser returns all or part of the goods (including cases where the value of the purchased goods changes due to product exchange), the seller is required to issue an adjustment invoice. However, if both parties agree that the purchaser will issue an electronic invoice to the seller at the time of the return, only the purchaser issues the electronic invoice.

4. Electronic Invoices Generated from Cash Registers

Decree 70/2025 revises and supplements Decree 123/2020/ND-CP regarding the use of electronic invoices created from cash registers that can transmit electronic data to the tax authorities.

a) Individual business owners and enterprises that meet the following conditions

– Those with annual sales of 1 billion VND or more who do not implement or only partially implement the accounting, invoicing, and evidence systems as stipulated in Article 51, Clause 1 of the Tax Administration Law.

– Sellers use cash registers in accordance with Article 90, Clause 2 of the Tax Administration Law.

– The company meets certain sales and employee size criteria for small-scale enterprises, based on regulations supporting small and medium-sized enterprises under Article 91, Paragraph 3 of the Tax Administration Law.

– The company uses electronic invoices with tax authority certification codes, allowing sales to be confirmed at the time of product sales or service provision.

b) A company that directly sells products or provides services to consumers based on the following business model

– Shopping malls, supermarkets, retail businesses (excluding automobiles, motorcycles, and other vehicles)

– Restaurants, hotels, passenger transportation services, direct support services for road transportation, artistic services, entertainment activities, movie screenings, and other personal services, etc.

However, on May 31, 2025, Circular No. 32/2025/TT-BTC was issued, supplementing additional provisions related to item b as follows. If the above-mentioned target companies have registered to use electronic invoices but do not meet the following conditions, they are required to register the use of electronic invoices created from the cash register.

– Electronic invoice or electronic data with tax authority authentication code, including information such as the seller’s name, address, and tax code, the purchaser’s name, address, tax code, personal identification number, phone number (if requested by the purchaser), product name or service name, unit price, quantity, and payment amount (sales price excluding VAT, VAT rate, VAT amount, and total payment including VAT).

– The timing of issuing the electronic invoice and the standard data format of the tax authority.

Conclusion

This report discusses the points to note regarding electronic invoices based on Decree 70/2025, which came into effect on June 1, 2025. Companies and others need to accurately understand the corrections and additions in order to appropriately respond and avoid administrative penalties for invoice violations.

References

– Decree 123/2020/ND-CP dated October 19, 2020

– Decree 70/2025/ND-CP dated March 20, 2025

– Circular 32/2025/TT-BTC dated May 31, 2025

This article was translated by Yarakuzen.