Points to note when applying for a refund of value added tax on goods and services for export

2023/07/27

- Masaya Sakai

1. Target of refund application

If a company has input VAT of VND 300 million or more on goods and services for export that have not yet been deducted in that month (for monthly declaration) or quarter (for quarterly declaration), you can apply for a VAT refund.

If the input VAT amount that has not yet been deducted in that month or quarter is less than VND 300 million, it will be deducted in the next month or quarter.

2. Determining the amount of VAT that can be refunded on export goods and services

2.1. For companies with only export activities

For companies that only engage in export activities, if the input VAT on goods and services for export that has not yet been deducted is VND 300 million or more, the VAT can be refunded.

The maximum refund amount is 10% of the sales of goods and services intended for export.

Example 1: Company A only exports software and declares VAT every month. Company A applies for a VAT refund for the period from January to May 2022.

・Total sales from software export: 4,000

・Undeducted input VAT until May 31, 2022: 500

⇒ The VAT amount that can be refunded is 500 of the input VAT, but it is subject to the following maximum refund amount limit.

Maximum refund amount: 10% x 4000 = 400

(Unit: 1 million dong)

2.2. For companies with both domestic sales and export activities

・For companies that engage in both domestic sales and export activities, it is necessary to separately record input VAT for export goods and services(①).

・If it cannot be accounted for separately, input VAT on goods and services for export will be determined based on the ratio of export sales to total sales during the refund application period(②).

⇒ The amount of input VAT on goods and services for export is offset with the amount of VAT paid on goods and services for domestic sale.

After that, if the balance is over VND 300 million, you can get a VAT refund.

The maximum refund amount is 10% of the sales of goods and services intended for export.

Example 2: Company B files a quarterly VAT return. Apply for a refund for the period from Q1 to Q4 2022.

・Total sales: 5,000, of which export sales: 4,000 Domestic sales: 1,000

・Purchase VAT amount within the period: 800

・Sales VAT amount for goods and services for domestic sale: 100 (①)

⇒The amount of VAT to be refunded is as follows.

・Ratio of export sales to total sales: 4000/5000=80%

・Purchase VAT on goods and services for export = 80% x 800 = 640

→Purchase VAT on goods and services for domestic sales = 800-640 = 160 (②)

・VAT amount paid for goods and services sold domestically = ①-② = 100 – 160 =-60

→goods and services sold domestically

There is no need to pay VAT. Therefore, 640% of input VAT on goods and services for export is refundable VAT.

However, the maximum refund amount is subject to the following restrictions.

・Maximum refund amount = 10% x 4000 = 400

(Unit: 1 million dong)

3. Points to note regarding required documents when applying for a VAT refund

Before submitting a VAT refund application to the tax department, enterprises are advised to carefully check whether the VAT return and related documents are complete and complete in accordance with the law. The required documents are as follows.

3.1. Refund application according to Circular 80/2021/TT-BTC

① Refund application form No. 01/HT

② Form No.01-1/HT for list of invoices and evidence for purchased products and services

*In the document, it is necessary to clearly state the invoice symbol and model number, as well as the details, unit price, and quantity of the purchased products and services.

③ Form No.01-2/HT of list of export-related documents that meet the conditions for 0% tax rate)

(0%)

3.2. Input VAT documents

①Vat invoice in accordance with laws and regulations, or VAT payment evidence at the time of import, or VAT payment showing that the tax was paid on behalf of a foreign corporation evidence.

②For goods and services (including imported goods) worth VND20 million or more, evidence showing that payment was made in a form other than cash (bank remittance certificate, etc)

③Other related documents: contracts, customs clearance documents for imported goods, etc.

3.3. Export documents

①A contract regarding the sale of products/services or the processing of products to foreign organizations/individuals

*For export consignment, the following documents are required.

Export consignment contract and export consignment contract settlement statement (if the contract has already been terminated)

Or periodic debt confirmation records between the export consignor and the exporter.

② Bank remittance certificate

③ Customs declaration regarding customs procedures (including when exporting software in the form of documents or records)

Customs declaration is not required in the following cases:

・Export of services and software by electronic means

・Construction and installation activities overseas or in non-tariff areas

・Provide electricity, water, stationery, and goods for the daily activities of export processing companies

3.4.Other documents

In addition to the above, the Tax Department may request the following documents:

① ERC (Enterprise Registration Certificate) and IRC (Investment Registration Certificate)

② Audit report

③ Accounting books

④ Corporate tax return

⑤ Inventory management table for materials, finished products, and products (management of stocking and receiving)

⑥ Regarding items related to VAT/export sales, if there is a discrepancy between the data in the accounting books and the data in the VAT/CIT return, the company need to explain in detail.

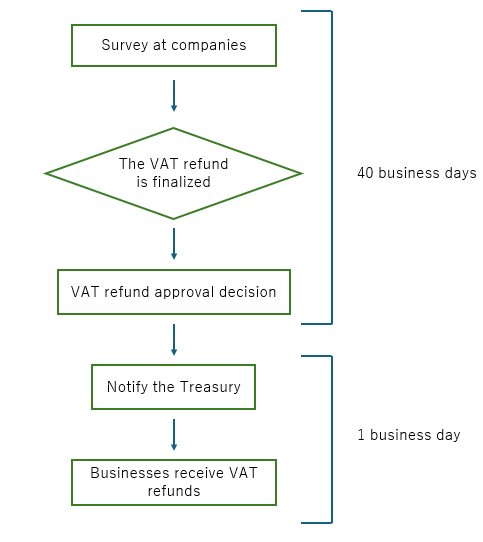

4. Procedures for VAT refund procedures and estimated time for completion

In practice, the refund procedure will be completed within one and a half to two months after the tax bureau receives the VAT refund application.

References:

-Article 16 of Circular 219/2013/TT-BTC

-Article 2 of Circular 25/2018/TT-BTC

-Article 75 of Law No. 38/2019/QH14

-Article 28 of Circular 80/2021/TT-BTC

-Official letter 4740/TCT-CS dated October 13, 2017

*This article was translated by Yarakuzen.