Notification and filing procedures for global minimum tax

2025/05/07

- I-GLOCAL Co., Ltd.

- Partner

- Hirohito Yamanaka

In the previous report (https://www.i-glocal.com/en/report/250225/), we explained that the Global Minimum Tax (hereinafter “GMT”) is also applied in Vietnam, and that the basic concept is the same as in Japan and other countries [1].

This time, we will explain the notification and filing procedures for GMT in Vietnam.

Declaration is required even without additional taxation

The target companies for GMT are multinational corporate groups with an annual total revenue of 750 million euros (approximately 120 billion yen) or more in two or more of the last four fiscal years.

Even for the target companies, no additional tax will be imposed if the effective tax rate for the entire group of companies located in Vietnam is 15% or higher.

On the other hand, regardless of whether additional taxation applies, the target companies are required to complete the following notification and declaration procedures.

| No. | Procedure | Submission deadline |

| 1 | Notification from the representative company | Within 30 days after the end of the fiscal year of the ultimate parent company |

| 2 | Tax code registration for GMT | Within 90 days after the end of the fiscal year of the ultimate parent company |

| 3 | Submission of the Constituent Entity (CE) List | Within 9 months after the end of the fiscal year of the ultimate parent company |

| 4 | Tax filing (Including reports related to the application of the safe harbor) |

QDMTT (Top-up Tax): Within 12 months after the end of the accounting year of the ultimate parent company (for reference) IIR (Income Inclusion Rule): Within 15 months after the end of the accounting year of the ultimate parent company (within 18 months for the first year) |

The above procedure is considered a regulation that requires the taxpayer to submit information to the Vietnamese tax authorities to determine whether additional taxation is necessary, allowing the authorities to verify the taxpayer’s judgment during future tax audits.

Even if a Vietnamese corporation is not receiving preferential tax treatment and the corporate tax rate is 20%, attention is required if it qualifies as a GMT-eligible company.

In particular, if the final parent company’s fiscal year end is before March, the “No.1 representative company notification” is already past the deadline, so prompt action is required.

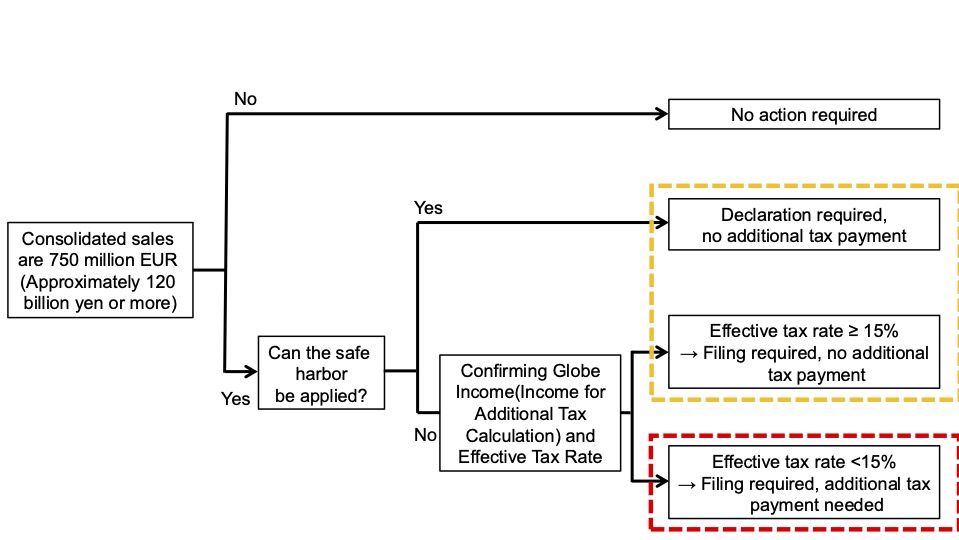

When summarizing the GST filing procedures and actions related to additional taxation in a flowchart, it is as shown in the table below.

What is a safe harbor?

In the above flowchart, there is an item labeled “Can the safe harbor be applied?”

Safe harbor is a system that allows for exemption from declaring and calculating the top-up tax by omitting the calculation of taxable income (GloBE income) and effective tax rate (ETR) based on the GMT rules.

It can be applied, for example, when the combined sales and profits of all constituent entities located in Vietnam fall below a certain threshold.

Since simplification and efficiency of the declaration process can be expected, it is recommended that companies subject to GMT consider early whether the safe harbor applies.

[1] The United States has announced its withdrawal from the OECD international tax rules, including the GMT, and future developments are receiving attention.

https://www.jetro.go.jp/biznews/2025/01/fee893f5e003a67e.html

This article was translated using Yarakuzen.