Points to Note About Full Remote Work from Vietnam: The Key to Balancing Family Accompaniment and Career Continuity

2025/09/11

- I-GLOCAL.CO., LTD Hanoi Office

- Certified Fraud Examiner

- Kiriko Kashima

Introduction

Since the COVID-19 pandemic, inquiries about full-time remote work for spouses accompanying expatriates in Vietnam have rapidly increased. Until now, it has been considered difficult to balance accompanying assignments with continuing one’s career, but with the establishment of remote work and increased flexibility in company regulations, cases of working overseas while maintaining employment in Japan are steadily on the rise. For example, there are cases in which, when the husband’s overseas assignment is decided, the wife continues to work full remote under her Japanese employment contract, and the whole family relocates to Vietnam. Recently, the opposite is also seen, where the wife is assigned abroad and the husband accompanies her while working fully remotely. While such trends symbolize the diversification of work styles, challenges cannot be ignored regarding residency permits, work authorization, and personal income taxes. This article explains the points to keep in mind when working fully remote under Japanese employment while accompanying family to Vietnam.

1. Procedures when leaving Japan

If a spouse leaves Japan as a dependent family member and becomes a non-resident of Japan, they will continue to be employed by a Japanese company, but an interim year-end tax adjustment must be done at the time of departure. This is a process in which the usual year-end tax adjustment is conducted separately at the time of departure. If you have salaries from two or more sources, or your annual income exceeds 20 million yen, and you are required to file a tax return, you must file a quasi-final tax return or appoint a tax agent to file the tax return on your behalf. The year-end tax adjustment at the time of departure is handled in the same manner as for seconded employees, and it is also possible to continue enrollment in Japanese social insurance.

2. Vietnamese Visas and Work Permits

In the case of seconded employees, it is common to enter Vietnam with a business visa based on an invitation letter from the Vietnamese entity, and simultaneously obtain a work permit. After that, the business visa is changed to a residence card (or work visa). For the family members of an expatriate, they enter the country with a dependent visa linked to the expatriate’s residence card. If the spouse continues to be employed by a Japanese company or works remotely under a business outsourcing contract, it is not necessary to obtain a work permit in Vietnam, and the visa will also be a dependent visa.

From a labor perspective, technically a work permit is required to work in Vietnam, but since the employer is not based in Vietnam and the income is also generated abroad, it is not required from the standpoint of labor law. On the other hand, from a tax perspective, the location of the employer is irrelevant—if the spouse themselves is a resident of Vietnam, they have a tax obligation. Regardless of the country of the affiliated company, where the salary is paid, or the currency of the income, all worldwide income is subject to taxation, resulting in a tax obligation in Vietnam. Please refer to the table below for responses regarding labor and tax matters.

▼Status of spouses who accompanied family to Vietnam

| Full-time housewife (or househusband) | Employment or service agreement with a Japanese company | Employment contract with a Vietnamese company | |

| Work permit | Not required | Not required | Acquisition |

| Residence card | Accompanied by family | Accompanied by family | Obtained in connection with a work permit from a Vietnamese company |

| Personal income tax | Not required | Required | Required |

3. Tax matters after entering Vietnam

3.1. Tax in Japan

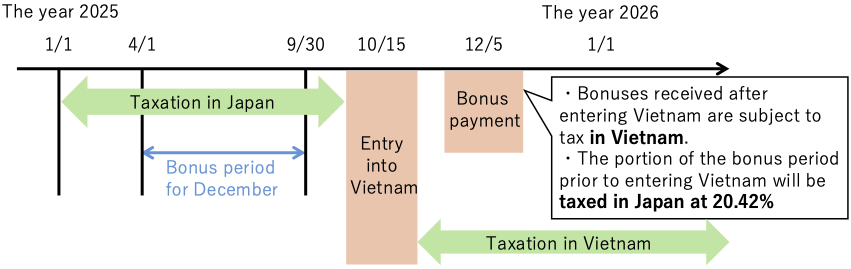

Whether Japanese taxes apply after entering Vietnam depends on the spouse’s residency status in Japan, place of work, and nature of duties. Basically, activities carried out within Japan are considered sourced in Japan, so if work is performed remotely from Vietnam, it is generally believed that Japanese taxes will not be imposed. On the other hand, income earned while temporarily returning to Japan to work or directors’ remuneration from a Japanese corporation will be subject to a withholding tax of 20.42%. Also, if a bonus is paid after coming to Vietnam, and the bonus period includes days worked in Japan, only the portion corresponding to work in Japan will be subject to a withholding tax of 20.42%. Please refer to the diagram below for a visual representation

Similarly, in cases where, under family accompaniment, a spouse changes from an employment relationship with a Japanese company to a ‘contract for services,’ as a general rule, unless the work is conducted within Japan, it does not qualify as Japan-sourced income.

Therefore, when deliverables are submitted to a Japanese company remotely from Vietnam, there is no Japanese taxation imposed.

However, for any part of the work performed in Japan during a temporary return, the Japanese company is required to withhold 20.42% as withholding tax when making payment for that portion as it is considered Japan-sourced income.

3.2 Taxation in Vietnam

As mentioned above, although a work permit has not been obtained, because the individual qualifies as a Vietnamese resident, there is an obligation to pay taxes in Vietnam on worldwide income. Here, we will explain the basic concepts and procedures related to personal income tax in Vietnam.

<Vietnam Residents and Non-residents>

A Vietnamese resident is defined as someone who meets any of the following conditions:

□ Stays in Vietnam for 183 days or more during the calendar year (1/1–12/31).

□ Stays in Vietnam for 183 days or more within 12 months from the first day of entry into Vietnam.

* From the second year onward, the determination is based on the calendar year.

□ Has a rental contract (under the spouse’s name) for 183 days or more within the tax year.

If you fall under any of the above categories, you will be deemed a resident in Vietnam and your worldwide income will be subject to taxation. This applies regardless of whether you are on a dependent visa, employed in Japan, or have your salary deposited in a Japanese bank.

On the other hand, if you do not fall under any of the above categories, you will be considered a non-resident of Vietnam. Although there is no specific legal provision, in practice, holding a residence card (such as a dependent visa) may result in being classified as a resident. Therefore, if you stay for less than 183 days but have a residence card, it is recommended to obtain a certificate of residence from overseas.

<Tax Rate>

Residents of Vietnam are subject to progressive taxation on worldwide income at rates from 5% to 35%, while non-residents are taxed at 20% on income sourced from Vietnam. It is assumed that many of the readers of this article fall under the case of being a resident of Vietnam. If you receive your salary in foreign currencies such as Japanese yen, you must convert it to Vietnamese dong using the exchange rate of the Vietnamese commercial bank on the payday, then determine the applicable tax rate. As a reference, please use the following converted amounts in yen to estimate your own tax rate.

▼Progression of Income Tax Rates for Residents in Vietnam

| Monthly taxable income | Approximate amount in yen (reference) | Tax rate |

| ~5,000,000 VND | Up to 28,000 yen | 5% |

| 5,000,000 ~ 10,000,000 VND | 28,000 ~ 56,000 yen | 10% |

| 10,000,000 ~ 18,000,000 VND | 56,000 ~ 100,000 yen | 15% |

| 18,000,000 ~ 32,000,000 VND | 100,000 ~ 180,000 yen | 20% |

| 32,000,000 ~ 52,000,000 VND | 180,000 ~ 290,000 yen | 25% |

| 52,000,000 ~ 80,000,000 VND | 290,000 ~ 450,000 yen | 30% |

| 80,000,000 VND以上 | 450,000 yen or more | 35% |

*The amount in yen is a reference value calculated based on the exchange rate at the time this article was written.

<Method of declaration>

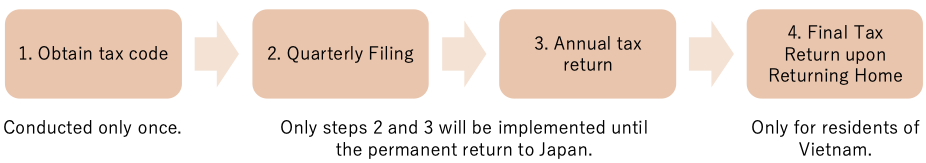

Since you do not belong to a Vietnamese company, you need to file and pay taxes as an “individual.” If you file as an individual, you must report your overseas quarterly salary collectively by the end of the month following each quarter. For example, the salary received in January, February, and March must be reported by the end of April. Furthermore, you must file your final tax return for the calendar year’s income by the end of April of the following year. If your stay in Vietnam during your initial year of entry is less than 183 days in the calendar year, you will need to calculate taxable income for the twelve months starting from the month of entry, and file your tax return within four months after the twelve-month period. Please note that if you are a Vietnamese resident who has stayed in the country for 183 days or more in the calendar year you return home, you are required to file a tax return within 45 days from the date of departure.

3.3. PE (Permanent Establishment) risk in Vietnam

A PE (Permanent Establishment) in Vietnam refers to a business base through which a foreign corporation conducts business in Vietnam, including fixed facilities such as branches, offices, factories, and construction sites, as well as “service PEs” where services are provided in Vietnam for more than 183 days, and “agent PEs” where an entity has the authority to conclude contracts in Vietnam. When an accompanying spouse works remotely from their home in Vietnam while retaining an employment relationship with the company’s headquarters in Japan, this generally does not meet the requirements for any of these PEs. The reasons include the fact that a home is not easily considered a company facility, the spouse does not have the authority to sign contracts in Vietnam, and services are not being provided within Vietnam.

In Conclusion

In recent years, the spread of remote work has allowed spouses accompanying overseas assignments to continue their own careers. However, if one continues to work without properly understanding the tax rules, it can result in ‘unintentional tax evasion,’ contrary to one’s intentions. We hope that this article will help you understand the system and confirm the necessary procedures, providing support for you to continue your career with peace of mind. Please note that all tax procedures in Vietnam must be conducted in Vietnamese, making it practically difficult for individuals to complete them on their own. It is advisable to proceed while consulting with a reliable professional when handling these matters.

Contact Information

I-GLOCAL CO., LTD. https://www.i-glocal.com/

Person in Charge: Kiriko Kashima

info@i-glocal.com

Ho Chi Minh Office +84-28-3827-8096 Hanoi Office +84-24-2220-0334

Related reports can be found here.

We introduce reports related to this topic below. Please be sure to take a look.

・ベトナム社会保険の概要と法改正等による企業と駐在員への影響

・ベトナム駐在員の一部手当に対する税務メリットと留意点

・駐在員の帰任時における個人所得税申告納税に関する留意点