Main Amendments in the 2025 Revised Corporate Law and Related Government Ordinances

2025/08/27

- Nguyen Nhu Phuong Anh

Introduction

The revised Corporate Law of 2025 (hereinafter referred to as the “Revised Law”) will come into effect on July 1, 2025, and related guidance such as government ordinances and notifications concerning corporate registration will also become effective on the same date. The purpose of this revision is to organize and clarify points that were unclear or contradictory in practice under the previous regulations. It also aims to further strengthen transparency and accountability in corporate activities. This article explains the key amendments that companies should particularly pay attention to.

1. Introduction of new regulations regarding “beneficial owners”

The amended law and Government Decree No. 168/2025/ND-CP (hereinafter “Decree 168”) explicitly stipulate provisions concerning the “beneficial owner” of a company. A beneficial owner refers to an individual who ultimately owns or controls the capital and management of a business entity with legal personality. Although this concept was already defined in the 2022 Anti-Money Laundering Law, the recent amendment has further clarified its definition to align with the Financial Action Task Force (FATF) recommendations led by the G7. The identification of the ultimate beneficiary is conducted based on one of the following criteria.

a) An individual who directly or indirectly holds 25% or more of the company’s registered capital or voting shares. An individual who indirectly holds through another organization 25% or more of the company’s registered capital or voting shares.

b) An individual who has control authority over the approval of any of the following matters.

・Appointment, dismissal, and removal of a majority or all members of the board of directors, chairman of the board, chairman of the general meeting of members, legal representative, president, or general president.

・Amendments and supplements to the company’s articles of incorporation.

・Changes to the company’s management organizational structure.

・Corporate reorganization or dissolution.

Under current laws and regulations, indirect ownership refers to holding 25% or more of a company’s equity capital or voting shares through another organization. However, regarding the method of determining the ultimate beneficial owner based on this definition, there is a divergence in practical interpretation depending on whether the intermediate corporations are organized in a single tier or in multiple tiers. From the perspective of preventing money laundering, it is generally considered that an individual who ultimately holds or controls 25% or more, even if there are multiple intermediate companies, is also regarded as a beneficial owner.

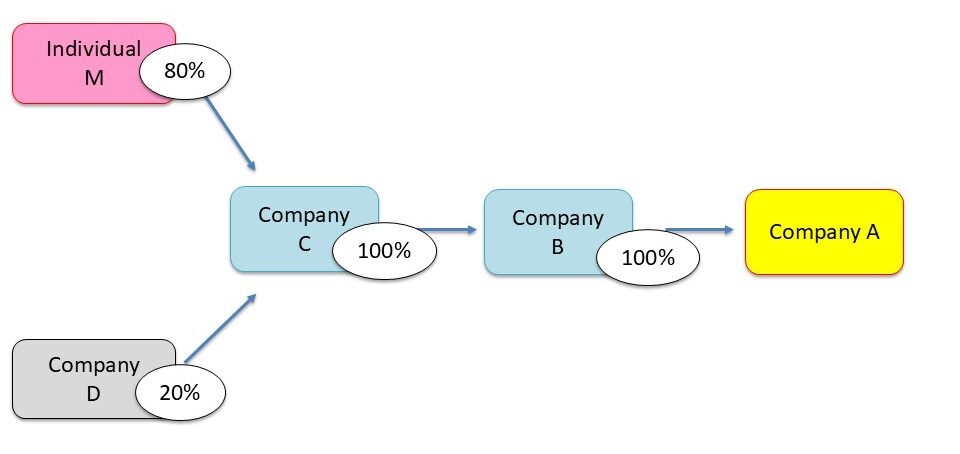

For example, in the structure shown in the diagram below, where Company B holds 100% of Company A and Company C holds 100% of Company B, the shareholding composition of Company C is 20% by Company D and 80% by individual M. In this case, since individual M indirectly holds 80% of Company A through two layers of intermediary companies (Company B and Company C), individual M is regarded as the beneficial owner of Company A.

Furthermore, the above interpretation is for reference only, and no clear additional guidance has been provided by the competent authorities at this time. Companies need to pay attention to future notifications and other communications.

Companies are subject to the following obligations regarding beneficial owners. First, information regarding the beneficial owners must be collected and updated throughout the business activity period, and stored at the head office location or other activity bases specified in the articles of incorporation. Additionally, even after a company has been dissolved, this information must be retained for at least five years.

Next, there is an obligation to report information regarding the beneficial owners and the information necessary to identify them to the competent authority at the time of establishment. Furthermore, if there are any changes to this information, it must be promptly reported to the competent authorities each time. For companies established before July 1, 2025, it is generally required that when there is a change in the registered information such as a change in the representative, information on the beneficial owners must also be submitted concurrently. If a company wishes to voluntarily report earlier than that date, early submission is also permitted. Information regarding the beneficial owners includes basic personal information of the individual in question, documents indicating their legal status, and information related to capital, shares, and control rights. When submitting this information, attaching supporting documents is not required.

At present, specific sanctions for violations of these obligations have not been clearly established, but detailed announcements are likely to be made in the future. Acts that violate these obligations may also be considered breaches of the Anti-Money Laundering Act and could be subject to penalties under that law.

2. Other Major Amendments

2.1. Revision of the Definition of “Market Price”

The “market price” of investment interests or shares refers to the price at which they are traded in the market, including prices agreed upon by the seller and buyer as well as prices calculated by appraisal agencies. The revision clarifies the definition of market price, and after the amendment, prices meeting the following two criteria will be regarded as market prices.

(i) For shares listed or registered on a stock exchange, either the average trading price over the 30 days immediately preceding the valuation date, the agreed price between the seller and buyer, or the price calculated by an evaluation agency.

(ii) For other equity interests and shares, either the most recent trading price in the market, the agreed price between the seller and buyer, or the price calculated by an evaluation agency.

This revision of the definition has established clearer criteria, especially regarding the calculation of market prices for listed shares. In third-party allotment capital increases (private placements), acquisition of treasury shares, and related party transactions using listed shares, it contributes to improving the transparency of price determination.

2.2. New regulations regarding capital reduction due to the repurchase of preferred redemption shares (joint-stock companies)

Under the amended law, joint-stock companies are required to reduce capital corresponding to the amount returned when they return the capital contribution to shareholders who hold preferred redemption shares. Preferred redemption shares are shares for which the company promises to buy back the shares from shareholders in the future under certain conditions and return the invested capital. Therefore, when the company actually buys back the shares and returns the invested capital, it is considered appropriate to simultaneously reduce the company’s capital stock.

This new regulation is intended to allow flexible adjustment of the company’s capital structure and is expected to increase management flexibility. Moreover, for shareholders who hold preferred stock, there is the advantage of increased liquidity of the shares, meaning it becomes easier to convert them into cash. As a result, shareholders are placed in an environment where they can retrieve their capital more flexibly. This revision can be said to be a system amendment that broadens the options for corporate capital policies while also making it easier and more reassuring for shareholders to invest funds.

2.3. Changes Regarding Corporate Registration Procedures and Application Forms

The procedures for company registration and the application forms will undergo significant changes due to Decree No. 168/2025/ND-CP and Circular No. 68/2025/TT-BTC, which will come into effect on July 1, 2025. The previous system that used electronic signatures and business registration accounts for the registration procedure will be abolished as a result of this revision. Instead, from now on, the procedure will be unified through an online dedicated system called the “National Enterprise Registration Portal,” using an electronic identification account (commonly referred to as a digital ID). An electronic identification account is an ID issued by the government for online personal authentication, and it is a system that allows you to proceed with applications after verifying the identity.

In conclusion

The 2025 amended corporate law and related guidance aim to address conventional practical challenges and create a business environment with greater transparency. In particular, procedures concerning the beneficial owners are a new system that many companies will need to comply with going forward. Taking this opportunity to review your company’s registered information and organize basic information can be expected to smooth the procedures. It is anticipated that additional guidance on the detailed operation of the system will be provided in the future. Companies are required to closely monitor the latest trends and respond flexibly according to their actual situation.

References:

– Law No. 59/2020/QH14 (2020 Enterprise Law)

– Law No. 76/2025/QH15 (2025 Revised Enterprise Law)

– Decree No. 168/2025/ND-CP (Regulations on Enterprise Registration)

– Notice No. 68/2025/TT-BTC (Guidance on the Corporate Registration Form)

[Contact Information]

I-GLOCAL CO., LTD.

Person in charge: Kiriko Kashima

kiriko.kashima@i-glocal.com

Ho Chi Minh Office +84-28-3827-8096

Hanoi Office +84-24-2220-0334

This article was translated by Yarakuzen.