What is global minimum taxation?

2025/02/25

- I-GLOCAL CO., LTD.

- Ho Chi Minh Office Partner

- Hirohito Yamanaka

Global Minimum Taxation (hereinafter referred to as “GMT”) is a system where countries cooperate to set and impose a minimum tax rate to prevent multinational corporations from lowering their overall tax burden by using tax havens or countries with low tax rates.

This system was institutionalized jointly by the OECD (Organisation for Economic Co-operation and Development) and the G20.

Mechanism of global minimum taxation

The outline of GMT is as follows.

・Target Companies: Multinational corporate groups with an annual total revenue of 750 million euros (approximately 120 billion yen) or more.

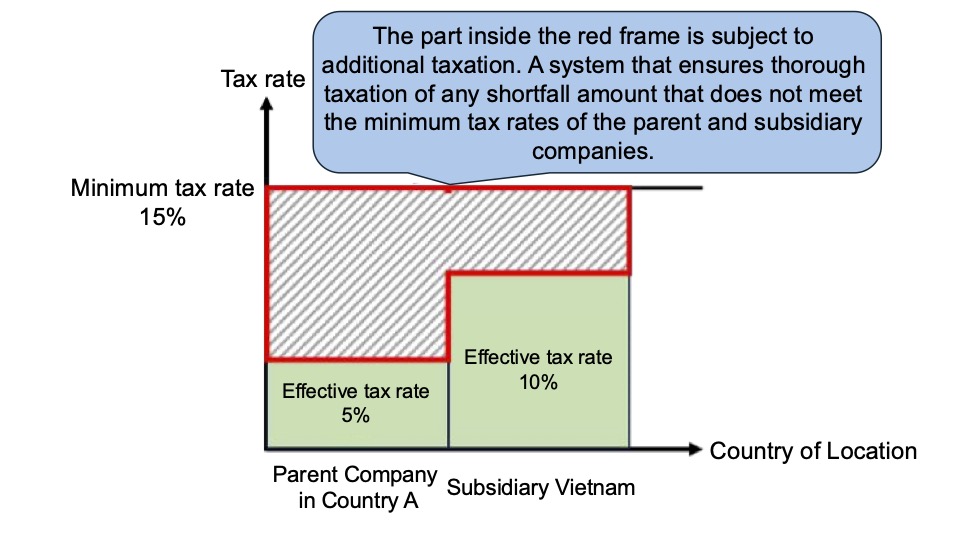

・Minimum Tax Rate: A minimum tax rate of 15% will be imposed regardless of the country in which the multinational corporations operate.

・Complementary Taxation: If the effective tax rate in a certain country falls below the minimum tax rate, other countries can tax the difference.

In Japan, GMT is being gradually legalized, and some rules apply from fiscal years starting on or after April 1, 2024.

In Vietnam, the National Assembly adopted “Resolution No. 107/2023/QH15,” which has been in effect since January 1, 2024, applying a tax system roughly in line with international rules. [1] However, the specific application methods and procedures are still under consideration. A draft government decree detailing them was published on November 14, 2024, and opinions are currently being solicited from government agencies, the Vietnam Chamber of Commerce and Industry, business associations, and general companies.

For example, if the effective tax rate of a multinational corporation conducting business in Vietnam is less than 15%, the difference will be subject to additional taxation in Vietnam (top-up tax). Additionally, if an overseas subsidiary of a multinational corporate group with a parent company in Vietnam is subject to a tax rate below 15% and there is no top-up tax levied in the country where the subsidiary is located, the shortfall may be subject to additional taxation in Vietnam (income inclusion rule).

Japanese-Vietnamese companies affected by the application

When considering the impact of GMT, the first things to examine are the tax rate applicable to your company and the sales scale of the consolidated group.Since the corporate tax rate in Vietnam is 20%, if any preferential tax treatment is not received, it will not violate the 15% minimum tax rate, and no additional taxation will occur.Additionally, since the consolidated sales amount to 120 billion yen, which is relatively large, there is a possibility that it will be exempt from additional taxation from the perspective of sales scale.

If your company becomes subject to additional taxation, it is recommended to collaborate with local tax experts and the parent company to first estimate the amount of additional tax and analyze its impact on cash flow.

Companies that are highly likely to incur additional taxation include, for example, the following types.

・Companies utilizing preferential tax systems provided to attract foreign investment.

Example: High-tech industries (IT software development, semiconductor manufacturing), renewable energy.

・Companies located in economic special zones receiving corporate tax incentives.

Example: High-tech parks of each ministry and industrial complexes of each ministry

Vietnam has offered various preferential tax incentives to attract foreign investment, but since these benefits will be lost due to GMT, the government is considering alternative preferential measures.

For example, ideas being considered include providing subsidies for factory construction costs at the time of new entry, as well as reductions or exemptions for taxes other than corporate tax and for land use rights lease fees to the government.

According to the draft government ordinance, GMT target companies (multinational corporate groups with annual total revenues of 750 million euros or more) are required to submit about 10 new GMT-related forms when filing their corporate tax returns, regardless of whether additional taxation is imposed, which is expected to increase administrative burdens on companies[2]. Since the draft ordinance is expected to be finalized soon, let’s closely monitor future legislative developments.

[1] As stated in the linked document, there are cases in Japan where exemption from application applies.

For details, please check the laws and regulations established in each country.: https://www.nta.go.jp/taxes/shiraberu/kokusai/global-minimum/pamphlet.htm

[2] If a multinational corporate group has multiple subsidiaries in Vietnam, one company designated by the ultimate parent company will representatively file the declaration.

According to the draft government ordinance, the deadline for submitting the additional form is one year from the ultimate parent company’s fiscal year-end.

This article was translated using Yarakuzen.