Overview of Corporate Tax in Vietnam

2025/07/03

- I-GLOCAL CO., LTD.

- USCPA

- Katsuki Kumagai

Corporate Income Tax (CIT) in Vietnam is imposed on corporations that conduct business domestically. It is significantly different from the Japanese tax system, and if not properly handled, it may result in unnecessary tax burdens, so a proper understanding of deduction schemes, tax filing and payment schedules, and tax audit practices is the key to tax management. This article explains the basic rules of corporate income tax and important practical points.

1.Subject to suspension of departure

Vietnam’s corporate tax rate has been consistently lowered in recent years, and is currently set at 20%, which is an attractive level compared to neighboring countries.

Changes in Tax Rates

|

Period |

Tax Rates |

| ~2008 | 28% |

| 2009~ | 25% |

| 2014~ | 22% |

| 2016~ | 20% |

Comparing to other countries

|

Country |

Tax Rates |

| Vietnam | 20% |

| Japan | 30~35% |

| China | 25% |

| Thailand | 20% |

| Malaysia | 24% |

| Indonesia | 22% |

| Philippine | 25% |

2. Overview of Tax Audit in Vietnam

2.1. Overview of Tax Investigations

In Vietnam, there is hardly any review during tax filings, and even if there are violations of tax laws, they are generally discovered mainly during subsequent tax audits. Therefore, not only is it important to carry out appropriate tax processing, but tax management that anticipates post-filing responses is also crucial.

Furthermore, it is highly likely that a tax audit will be conducted at least once every five years, and at that time, past filing details will be retrospectively checked. In particular, sufficient documentation is required for transactions with high tax risks and for the application of deductions or exemptions.

Furthermore, for Japanese companies, the tax audit team in charge of Japanese companies generally handles the audits, so an investigation that takes into account the tendencies of Japanese businesses can be expected. In other words, if tax processing is carried out without properly understanding the differences from Japanese tax practices, it could result in unexpected additional taxes. Given this background, preparation and response to tax audits become important points in business operations.

2.2. High risk of additional tax burden

The additional taxation during tax audits in Vietnam is as follows.

| Type of additional tax burden | Amount of money | Statute of Limitations |

| Principal Tax (Shortfall) | Correct tax amount − Amount already paid | 10 years |

| Late Payment Interest | 0.03%/day(10.95%/year) ※0.05%/day until June 2016 |

10 years |

| Penalty for Tax Underpayment (underpayment, Excessive Refund) |

20% of tax shortfall | 5 years |

| Penalty for Illegal Acts (tax evasion and illegal acts) |

100%–300% of tax deficiency | 5 years |

| Late filing penalty | 15,000,000 ~ VND 25,000,000/case | 2 years |

| Administrative penalty | Up to 200 million VND (equivalent to 1.2 million yen) | N/A |

For comparison, the following is a simplified outline of additional tax collection in Japan as of 2025.

| Type of additional tax burden | Amount of money | Statute of Limitations |

| Principal tax (Shortfall) | Correct tax amount − Amount already paid | 5 years (exception: 7 years) |

| Late Payment Interest | ① 2.4% per year (7.3% or the special standard rate plus 1%, whichever is lower) for two months from the day after the payment due date ② After the day after ①, 8.7% per year (14.6% or the special standard rate plus 7.3%, whichever is lower) |

5 years (exception: 7 years) |

| Underreported tax penalty | 10%-15% of the shortfall in the main tax | 5 years (exception: 7 years) |

| Failure-to-file penalty | 15% to 30% of the unpaid main tax | 5 years (exception: 7 years) |

| Serious additional tax (In cases of malicious acts such as disguise or concealment) |

35% instead of the underreporting penalty, 40% instead of the non-filing penalty | 7 years |

Additional Information

・The statute of limitations is generally five years; if false statements or other fraudulent acts are recognized, it is seven years.

・The late payment interest rate fluctuates in accordance with the special standard rate.

・From one year after the statutory due date until the day of amended return (or reassessment), late payment interest is exempted.

① Heavy burden of additional tax and late payment charges

In Vietnam, the burden of additional taxes and late payment penalties arising from tax audits is significant. In particular, the late penalty rate is 10.95% per year (0.03% per day), which is higher than in Japan, and the statute of limitations is also longer in Vietnam. Furthermore, there is no system of grace periods as there is in Japan. It is important to thoroughly carry out proper tax procedures and ensure payment within deadlines in order to minimize risks.

② Severe penalties for fraud

For tax evasion and fraudulent acts, a fine of 100% to 300% of the additional tax amount will be imposed, which can significantly affect corporate management. To avoid being accused of unintentional wrongdoing, it is necessary to implement thorough tax management, such as keeping accurate records and preparing appropriate documentation.

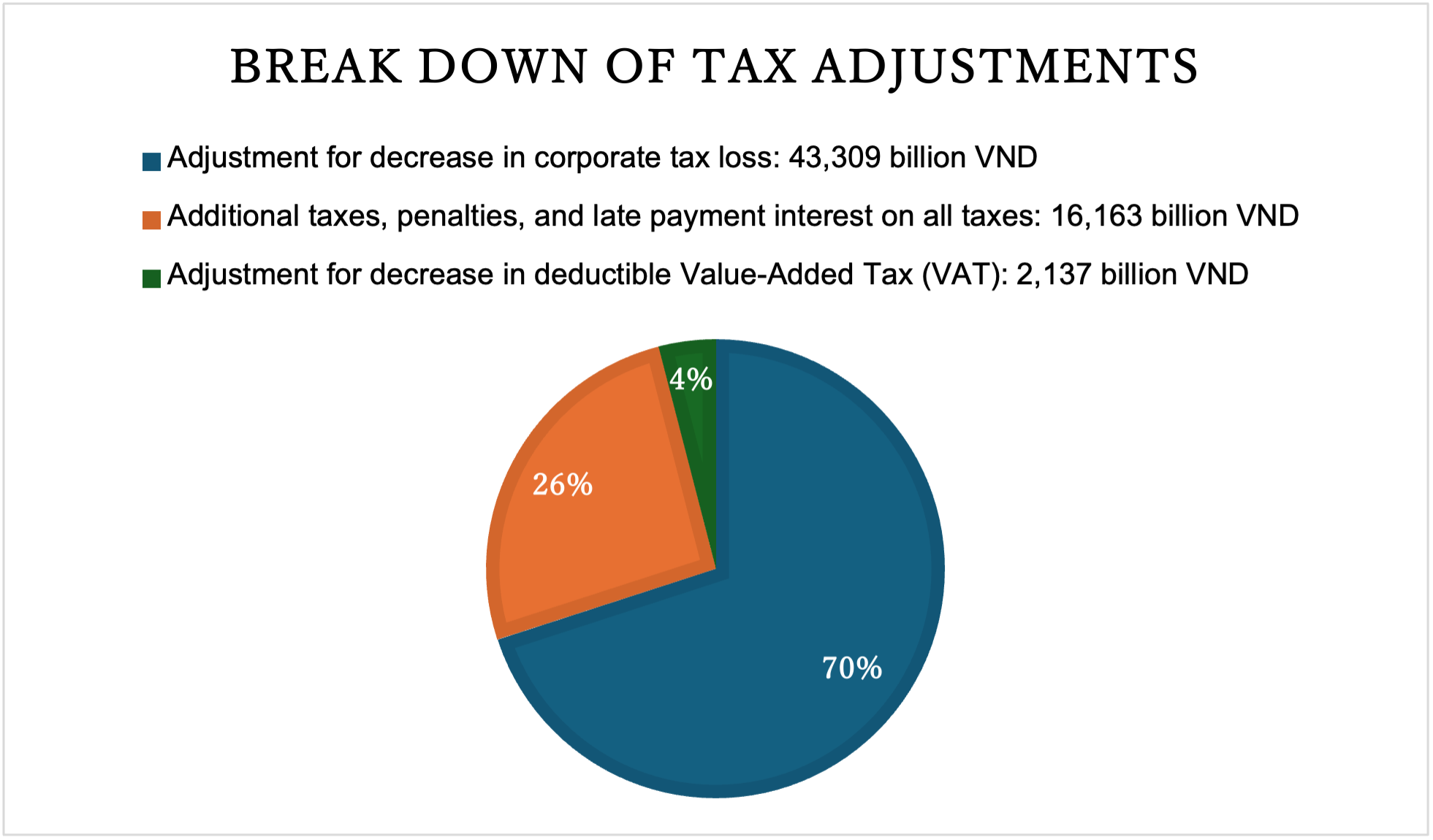

2.3 Tax audit results (Source: General Administration of Taxation Website)

In 2023, there were 66,241 tax audits, resulting in approximately 6.2 trillion VND in additional taxes identified.

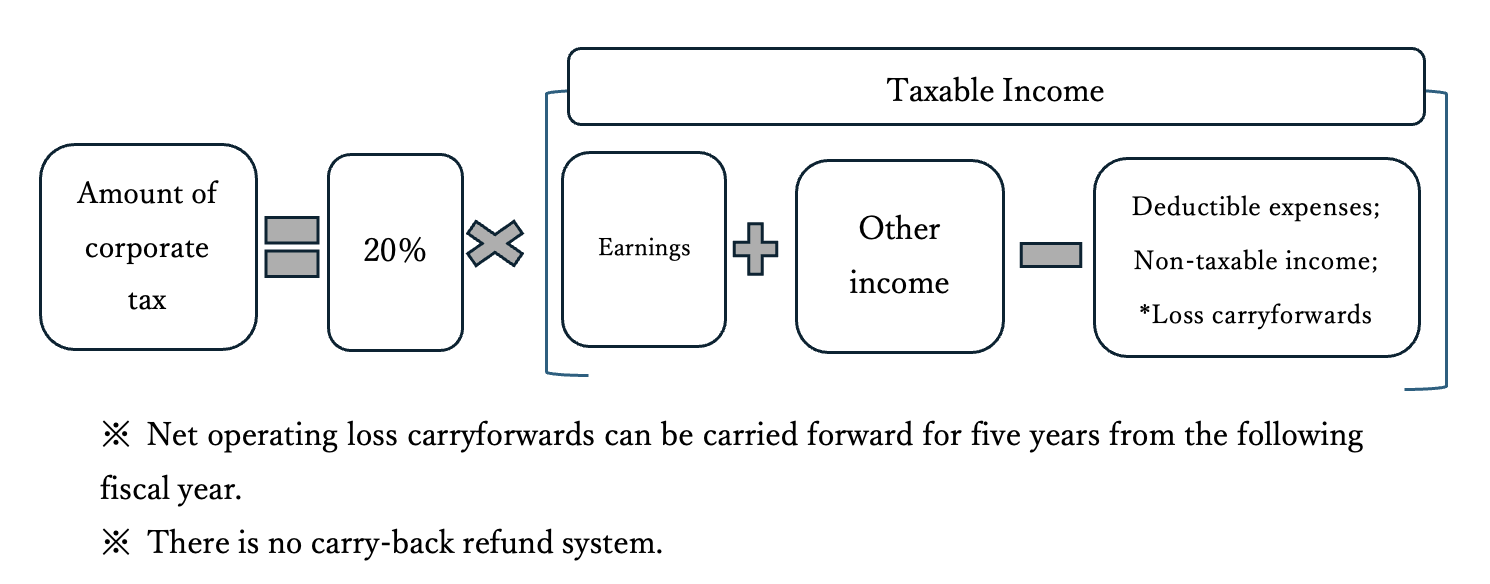

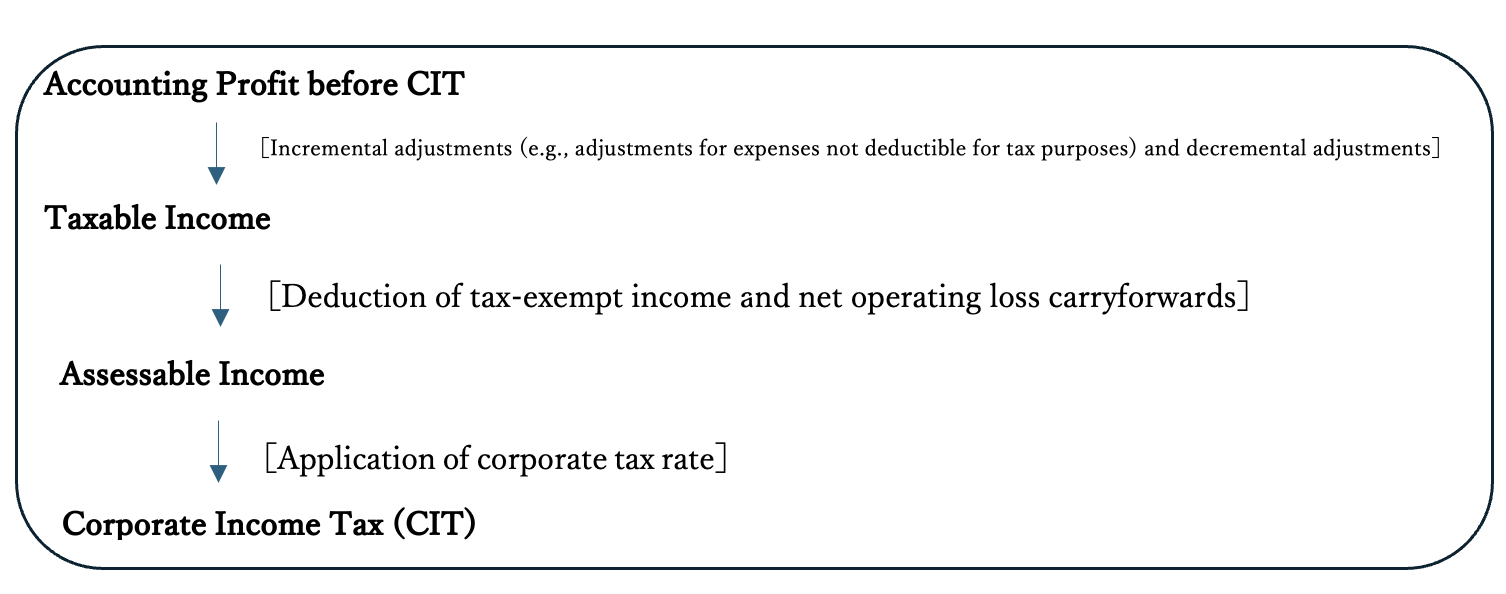

3. Corporate Tax Calculation Method

The basic image of corporate tax calculation is as shown in the following diagram.

In the actual corporate tax return, the calculation is done according to the following flow.

4. Requirements for deductible expenses

In calculating taxable income, all of the following four requirements for deductible expenses must be satisfied.

・Expenses related to the company’s business activities

・Possession of an appropriate VAT invoice

・Possession of appropriate evidence (such as contracts or internal regulations) corresponding to the transaction

・Payments of 20 million VND or more must be settled by means other than cash.

Below, we introduce practical points to consider for each requirement.

4.1. Cost related to the company’s business activities

There are no laws that clearly define costs related to business activities, and in tax audits, there is a possibility that an expanded interpretation could determine that certain costs are not related to the business. Main examples of disallowance include the following expenses:

・Fees for golf play, golf membership

・Fees for karaoke, massage

・Fees for visa, residence card, family airfare, children’s school bus

・Fines to authorities

4.2. Have appropriate VAT invoices

Japan’s invoice system is only related to input tax deductions for consumption tax, but in Vietnam, it is one of the requirements for deductibility under corporate income tax.

Therefore, it is important to always have a VAT invoice issued and to keep the following points in mind.

・The company name, tax code, and address must be accurately stated in Vietnamese.

・For expenses incurred overseas, it is necessary to have receipts and other related documents translated into Vietnamese.

4.3. Have appropriate vouchers (contracts, company regulations, etc.) for the transaction

In a tax audit, tax losses may be denied immediately due to inadequate vouchers, without waiting for an explanation of the actual transaction. The required vouchers vary depending on the nature of the transaction, and an understanding of various legal provisions is a key point.

For example, bonuses, various allowances, travel expenses, benefits, and various expenses for expatriates may be disallowed as deductible expenses due to insufficient descriptions in labor contracts or company regulations.

In addition, assets and materials brought into Vietnam by hand-carry, such as expatriates’ computers, may be denied as deductible expenses on the grounds that the customs clearance documents at the time of importation were not kept.

4.4. Payments of more than 20 million VND are settled in non-cash

Payments of 20 million VND or more including value-added tax must be made through non-cash methods such as bank transfers or credit cards. It is important to note that cash payments are not recognized as deductible expenses. Additionally, when offsetting the value of purchased goods or services against the value of sold goods or services, if the contract does not clearly specify the method of offset settlement, the expense may be disallowed.

To avoid such tax risks, it is important to clearly state the appropriate settlement methods in the contract and to properly maintain supporting documents.

5. Schedule of Tax returns and Payments

5.1. Annual Tax returns

The deadline for the annual tax return filing and tax payment is the last day of the third month following the end of the selected fiscal year.

| Fiscal year (taxable year) | Due date of tax return and tax payment (end of the month within 3 months after the end of the period) |

| Fiscal year ending in March (April-March) | 6/30 |

| Fiscal year ending in June (July-June) | 9/30 |

| Fiscal year ending in September (October-September) | 12/31 |

| Fiscal year ending in December (January-December) | 3/31 |

5.2. Scheduled tax payments (only if profitable)

No interim tax return is required, and the calculated amount should be entered on the designated payment form and paid accordingly.

| Duration | Due date for tax payment (within 30 days of the quarter) |

| First Quarter(Q1) | 4/30 |

| Second Quarter(Q2) | 7/30 |

| Third Quarter(Q3) | 10/30 |

| Fourth Quarter(Q4) | 1/30 |

If the total amount of provisional taxes paid for the first to fourth quarters is less than 80% of the amount due on the final return, a surcharge will be imposed on the shortfall up to 80%.

| Annual taxes at the time of filing | Total scheduled tax payments | Late fees |

| 100% | 80% or more | None |

| 100% | Less than 80% | Accrual for difference up to 80% |

Differences in Corporate Estimated Tax Calculation between Japan and Vietnam

In Japan, the tax office notifies eligible taxpayers of the estimated tax amount based on the previous year’s corporate tax (annual tax amount). On the other hand, in Vietnam, companies are required to calculate their own estimated tax payments based on their current term income.

| Country | Criteria for calculation |

| Japan | Calculated based on income and taxes for the previous year |

| Vietnam | Calculated by the company based on the current year’s income |

5.3. Available Currencies

In Vietnamese accounting, either VND or foreign currencies can be used, and the main transaction currency can be selected. On the other hand, for tax filing and payment, only VND can be used, and transactions in foreign currencies must be converted to VND for processing.

| Process | Accepted Currencies |

| Accounting | VND or foreign currency ※Use major trading currencies |

| Tax Returns and Payments | only in VND |

6. Preferential Taxation

Typical tax incentives are as follow:

| Business Category | Preferential treatment |

| Manufacturing Industry | Tax exemption for 2 years + 50% of tax reduction for 4 years thereafter |

| Investment in expansion of manufacturing industry | Tax exemption for 2 years + 50% tax reduction for 4 years thereafter |

| Tax reduction for software development business | 10% preferential tax rate for 15 years, tax free for the first 4 years + 50% tax reduction for the following 9 years |

However, there are ambiguities in the regulations regarding the application of these preferential tax systems, and cases have been observed where the authorities interpret the rules in favor of taxation and deny the application. Specifically, the following cases may occur.

・Since the preferential tax rate was applied to taxable income from non-eligible businesses, it will be recalculated at the normal rate.

・The business is judged not to fall under software development, resulting in denial of the preferential tax treatment. When applying preferential tax systems, it is important to carefully confirm that the business content qualifies and to prepare clear evidence that the application requirements are met.

Conclusion

There are many differences between Vietnam’s corporate tax system and that of Japan, and in order to minimize tax risks, it is important to stay updated on the latest tax reforms and practical operations, and to respond appropriately. In particular, it is necessary to make preparations in advance for tax audits and to maintain proper supporting documents. I hope that the overview of corporate tax and practical points introduced in this article will help strengthen your company’s tax management system.

This article was translated by Yarakuzen.